The Transformation of Liquidity Risk to Solvency Risk in U.S. Companies and Suggestions for Banks

Insights SRD/New York Research Center1. The trident recovery of U.S. enterprises and its impact on their financial and credit status

During the COVID-19 pandemic, the Fed directly provided financial support to enterprises by sharing credit risks with banks, purchasing corporate bonds and providing loans to enterprises. The Fed has also tweaked its rules on banks' bad loans, giving firms more time to repay loans.

Congress has temporarily amended the bankruptcy code to avoid liquidation. These measures have prevented the liquidity risk of enterprises from turning into solvency risk; but the ultimate effects are very complex and uncertain. One of the key impacts is that corresponding to the K-shaped recovery of the macro economy, enterprises have also formed a trident recovery. This is due to the following reasons:

- Companies’ equity and bond market data have been improving rapidly since the end of March 2020.

- Accounting indicators that more truly reflect the financial and credit status of an enterprise lagged the market data. Most of these indicators continue to deteriorate including leverage ratio, stock indicators such as debt ratio (total debt/EBITDA); flow indicators such as interest coverage ratio ICR (EBIT/ interest expense), corporate debt service ratio DSR (total debt expense/income), short-term debt ratio and business loan default and write-off rates

- With business activity contracting sharply and remaining semi-closed, the recovery of enterprises’ fundamentals data, such as revenues, has lagged behind even further.

As a result, this largely obscures the true financial and credit conditions of firms and further accumulates their solvency risk.

2. The future credit status and solvency development prospects of U.S. enterprises

Corporate bankruptcies and defaults usually rise in the year of a recession, but they peak in the 2nd year and begin to decline in 3rd year. The decline, however, was limited and remains high.

2.1. The 2nd wave of bankruptcies is likely to occur in 2021, with small businesses being more vulnerable.

2.2. Delinquency and default rates are likely to rise.

If economic activity and income of corporate borrowers continue to stagnate, especially as the Fed's delinquency forgiveness program expires, the delinquency and default rates for corporate debt will increase.

The highest risk of default will be for non-investment grade bonds, especially those with lower ratings. The second highest risk will be for the low-grade portion of leveraged loans.

Fitch predicts that defaults on non-investment-grade bonds and leveraged loans will continue to rise until the end of 2022. S&P forecasts that U.S. default rate on non-investment-grade bonds will rise to around 9% in 2021; Leveraged loan defaults rose to 4.8%, and the cycle of rising defaults could last for 1-2 years.

The main risk for investment-grade bonds will be credit rating downgrade to non-investment-grade.

The overall risk of CLOs, especially those with higher ratings, is low. But as the pandemic continues, defaults on CLOs underlying assets and their impact on CLOs could rise.

Because 59% of all non-investment-grade corporate bonds will mature between 2021 and 2022, that period could potentially result in peak defaults. 56% of I & C loans including credit lines will be due between 2020 and 2022. Similarly, that period is also likely to result in peak defaults; Only 8% of Leveraged loans will mature in 2021 and 2022, with the peak occurring between 2024 and 2026, when the U.S. economy is likely fully recovered, therefore their default pressure is lower.

3. The impact of the increased solvency risk of U.S. companies on Chinese banks in the U.S. and the suggestions

3.1. Impact

Banks' overall credit losses could rise. S&P predicts that U.S. banking sector credit losses related to the pandemic could surge between 2020 and 2021, rising to 3% by the end of 2021. Consequently, the risk of systemic bank defaults remains high.

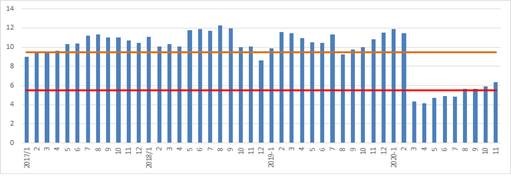

This is illustrated by The Bank Default To Distance Index, published by the Cleveland Fed, which dropped sharply to the historical danger zone at the beginning of the pandemic. As a result, banks were closer to default. Although they recovered slightly, they remained in the historical instability zone at the end of 2020. Also, the index was much lower than the level prior to the pandemic.

U.S. Banking Systemic Risk Indicator: distance-to-default

(Source: FEDERAL RESERVE BANK OF CLEVELAND and author’s calculation)

However, the huge increase in banks' loss provisions at the beginning of the pandemic can make up most of the losses, so banks are well capitalized and solvent, and are unlikely to suffer systemic damage.

In the meantime, liquidity risk may rise. The huge increase in bank deposits in 2020 may not be sustainable. M1 growth and M2 decline since November means that depositors are reducing time and savings deposits and increasing checking deposits and cash and may withdraw funds at any time. This could lead to a liquidity squeeze in an environment where banks' assets are growing.

Before the pandemic, the deterioration of Sino-U.S. relations had reduced bilateral trade and investment, which had already affected the business development of Chinese banks. Because of that, they face the same default risk as their U.S. peers during the pandemic, as well as a reduction of interest income due to falling interest rates. In addition, since Chinese banks' local customers in the U.S. are mainly enterprises, especially large ones, the impact of corporate default risk on Chinese banks is even greater, so it is more necessary to reasonably deal with corporate default risk.

3.2. Suggestions

The impact of the pandemic on the financial and credit status of enterprises goes beyond that of traditional recessions, and varies widely from industry to industry. The Fed's intervention in credit markets make corporate default risk more complex and less predictable. All these factors make the traditional credit risk analysis framework of banks non-applicable.

Chinese banks not only need to devote more resources to evaluate and handle loan delinquencies and defaults, but also need to adjust their credit risk assessment and forecasting framework and tools to adapt to the pandemic environment.

There are multiple ways Chinese banks can use their U.S. peers as a valuable resource.

First of all, Chinese banks should divide industries into high, medium and low risk categories according to the impact of the pandemic environment on different industries. Chinese banks need to meet their customers' liquidity needs to keep them alive while avoiding their own credit losses. However, in view of the specific impact and structural changes caused by the pandemic, the income of some industries may decrease forever. Therefore, it is necessary for banks to further subdivide the industries when making credit decisions, and also deeply analyze the long-term and structural impacts of the pandemic on each sub-industry, and predict their future trends as well.

Secondly, after the degree of industry risk is determined, the ability and performance of specific enterprises to cope with the impact of the pandemic, their degree of dependence on the government and the impact of government withdrawal need to be analyzed, and their willingness and ability to repay debt needs to be assessed in a timely manner. Particular attention needs to be paid to the situation of delinquent customers after the end of the grace period and the likelihood of zombie enterprises surviving in certain future scenarios.

Third, an indicator system that can better reflect the real financial and credit status of enterprises in the pandemic situation should be established.

- Market indicators are comprehensive, forward-looking and real-time, and need still be used as leading indicators. For example, the distance to default, as measured by a firm's market capitalisation, liabilities and asset volatility, can still be used as a reference index. But given that stock markets are so far ahead of corporate economic activity, there is a need to be noise sensitive when using such indicators. In addition, technologies such as big data and AI can be fully utilized to identify early signs of corporate default, convert qualitative information into quantifiable data, and integrated into default leading indicators as well.

- When making lending decisions and determining risk premiums, banks should use the following accounting indicators because they more truly reflect an enterprise’s financial and credit status: debt leverage ratio, debt-to-income ratio, interest coverage ratio ICR, debt service ratio DSR, and short-term debt /EBITDA ratio.

Reference

- Kristian Blickle, Fed: “The Costs Of Corporate Debt Overhang Following The COVID-19 Outbreak”,2020/12

- McKinsey: “A Test of Resilience: Banking through the Crisis, and beyond”, 2020/12

- S&P Global: “2021 Leveraged Loan Survey: Defaults edge higher; credit quality a concern”, 2020/12

- Jack McCoy, Fed: “Interest Coverage Ratios: “Assessing Vulnerabilities in Nonfinancial Corporate Credit”, 2020/12

- BAI: “Bankruptcy Statistics”

Disclaimer

Bank of China USA does not provide legal, tax, or accounting advice. This article is for information and illustrative purpose only. It is not and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action, including without limitation as those terms are used in any applicable law or regulation. Bank of China USA does not express any opinion whatsoever as to any strategies, products or any other information presented in this article. This article is subject to change without notice. You should consult your advisors with respect to these areas and the article presented herein. You may not rely on the article contained herein. Bank of China USA shall not have any liability for any damages of any kind whatsoever relating to this article. No part of this article may be reproduced in any manner, in whole or in part, without written permission of Bank of China USA.